Crypto

Major Banks Reveal Crypto Exposures in Unprecedented Report

Overview:

The Basel Committee on Banking Supervision (BCBS) has released a groundbreaking report that provides insight into the involvement of major banks in cryptocurrencies. The report reveals that banks have reported approximately €9.4 billion in crypto assets, marking a significant development in understanding institutional engagement in the crypto sector.

Key Findings:

– 19 banks reported their crypto assets, with 10 from the Americas, 7 from Europe, and 2 from other regions.

– These 19 banks account for 17.1% of total risk-weighted assets and 20.9% of the overall leverage ratio exposure measure.

– Banks from the Americas represent around three-quarters of the reported exposures.

– The €9.4 billion in crypto holdings represent only 0.05% of total exposures among reporting banks and reduce to 0.01% when considering the entire sample of banks in the Basel III monitoring exercise.

Dominance of Major Cryptocurrencies:

– Bitcoin (BTC) accounts for 31% of the reported exposures, followed by Ether (ETH) at 22%.

– Bitcoin and Ether-related instruments make up nearly 90% of the reported exposures.

– Other notable cryptocurrencies in the banks' portfolios include Polkadot (2%), XRP (2%), Cardano (1%), Solana (1%), Litecoin (0.4%), and Stellar (0.4%).

– For example, banks hold positions in XRP worth €188 million or $205 million.

Categories of Crypto Activities:

– The report categorizes banks' crypto activities into three groups: 'Crypto holdings and lending,' 'Clearing client and market-making services,' and 'Custody/wallet/insurance and other services.'

– Custody, wallet, and insurance services account for half of the reported exposures, while clearing and market-making services make up 46%.

– The most significant subcategories in terms of exposure include providing custody and wallet services (14.4%), trading crypto on client accounts (13.4%), and facilitating client self-directed trading (11.7%).

– The distribution of activities varies across banks, with most having exposures primarily or exclusively in one activity group.

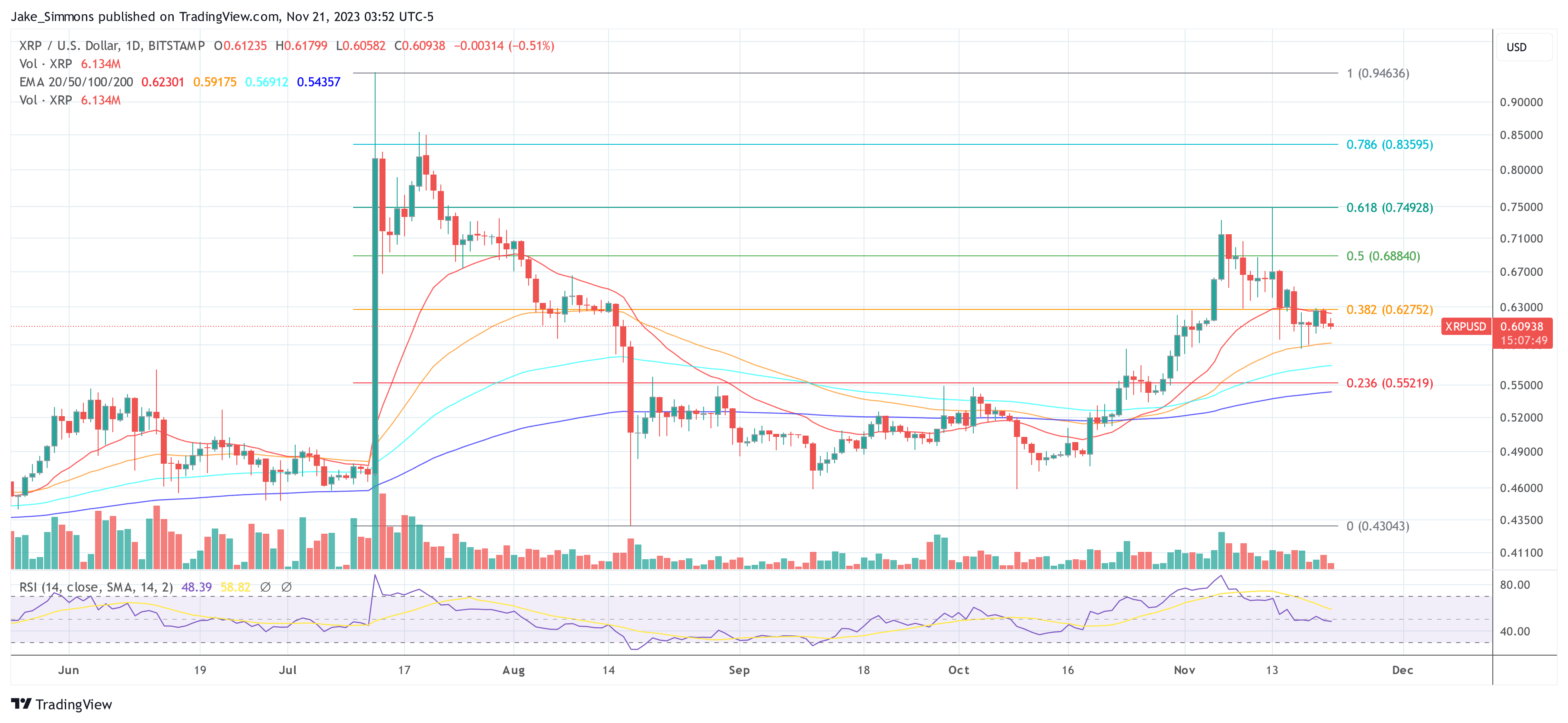

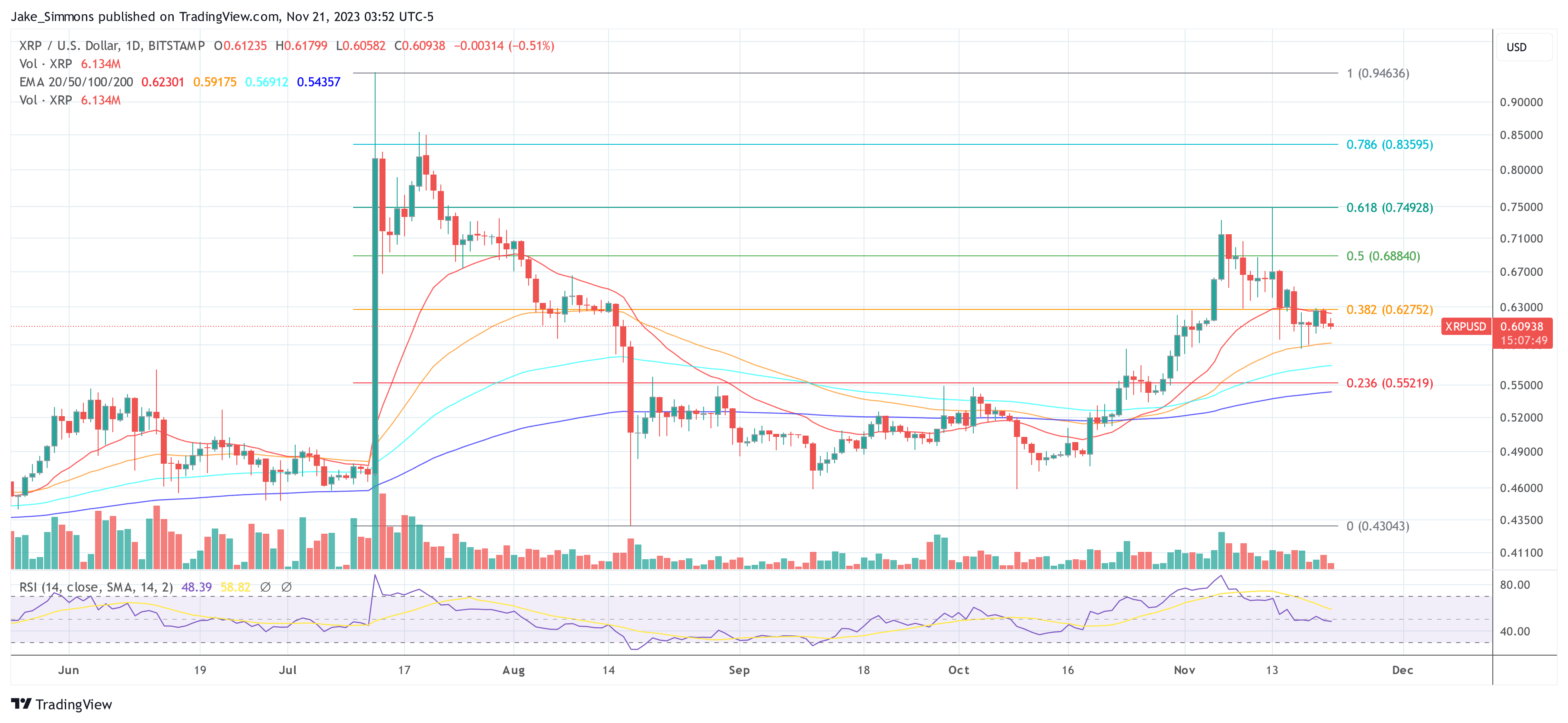

XRP Price Update:

At the time of writing, the price of XRP stands at $0.6094.

Hello, I’m Timothy Robinson, News Editor at NewsRoomFeed.com, where I turn the world’s chaos into digestible stories. Blessed with a journalism degree from UNT, I’ve been molding minds and spreading knowledge from the tranquil setting of Denver, CO.

My days are spent in the throes of international affairs, political commentary, and local happenings, but when the laptop closes, you’ll see a completely different side of me. I’m an avid tennis player and cycling enthusiast. I never shy away from a good adventure. My Labrador, Rocky, is always by my side as we explore the great outdoors of Colorado.

Traveling is my stimulant. It’s my way of stepping into new narratives, experiencing different cultures, and appreciating the beautiful tapestry of life. Each new place I visit fuels my creativity and broadens my perspective, which I pour back into my work at NewsRoomFeed.

When I’m not on the road with Rocky or lost in a gripping news story, you’ll find me on the tennis court or cycling around Denver. These hobbies keep me grounded and offer a refreshing escape from the digital universe.

I believe in creating a balance between the hustle of work and the peace in nature. So, if you’re looking for a fresh take on news, a travel companion, or an opponent on the tennis court, don’t hesitate to connect. Let’s turn the page on the ordinary and dive into the extraordinary!