Crypto

Bitcoin Analyst Predicts $1 Million Price Surge as ETF Money Flows In

A prominent figure in Bitcoin adoption and CEO of JAN3, Samson Mow, has ignited a heated debate in the BTC community with his bold prediction of a rapid surge in Bitcoin's value. Mow, known for his work on Bitcoin Bonds in El Salvador, recently stated on the social platform X, "It has come to my attention that there are some Bitcoiners that don't think Bitcoin can reach $1,000,000 in a matter of days/weeks after ETF money starts to flow in. They're in for a pleasant surprise."

Rapid Growth: Historical Analysis Supports Mow's Prediction

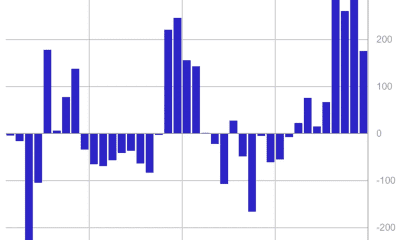

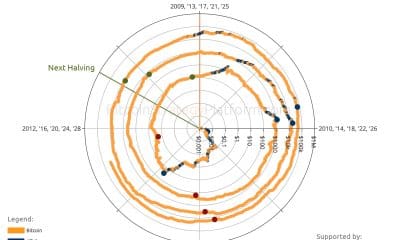

Mow further supported his prediction by referencing Bitcoin's historical growth. He pointed out that in 2017, it took approximately nine months for Bitcoin to go from $1,000 to $20,000. With the current block subsidy of 6.25, more institutional money flowing in, and a reduced supply of BTC on exchanges, Mow believes that the jump from $50,000 to $1 million would be equivalent to the previous 20x increase.

Mathematical Breakdown: Supply, Demand, and Capital Influx

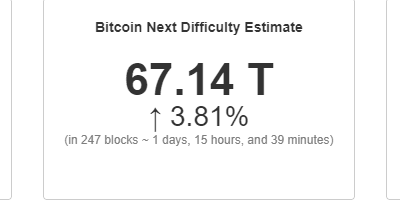

Bitcoin analyst Bit Paine provided a mathematical breakdown that supports Mow's prediction. Paine's analysis starts with the fundamentals of supply and demand. He calculates the new supply for the next cycle, estimating approximately 792,000 BTC.

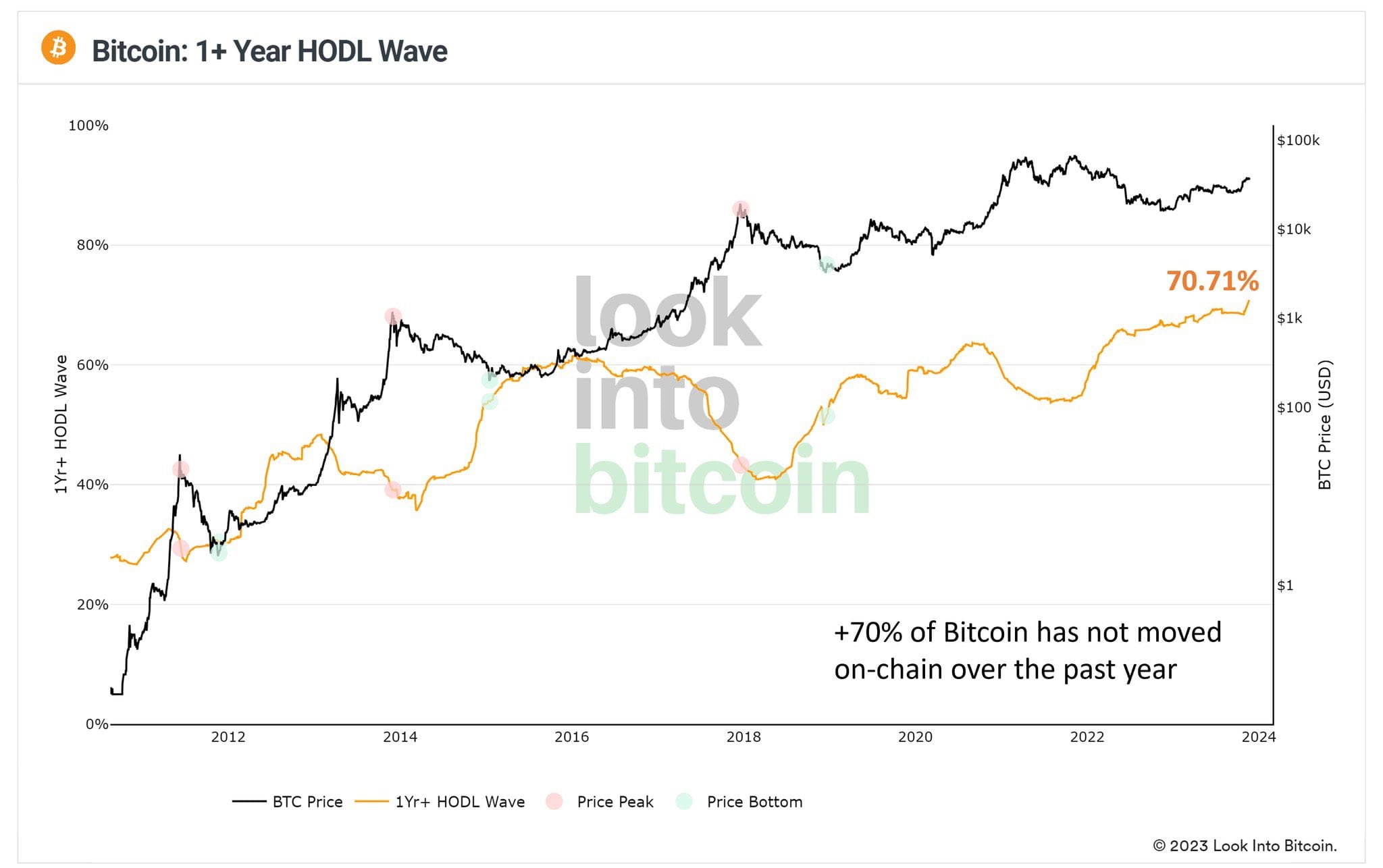

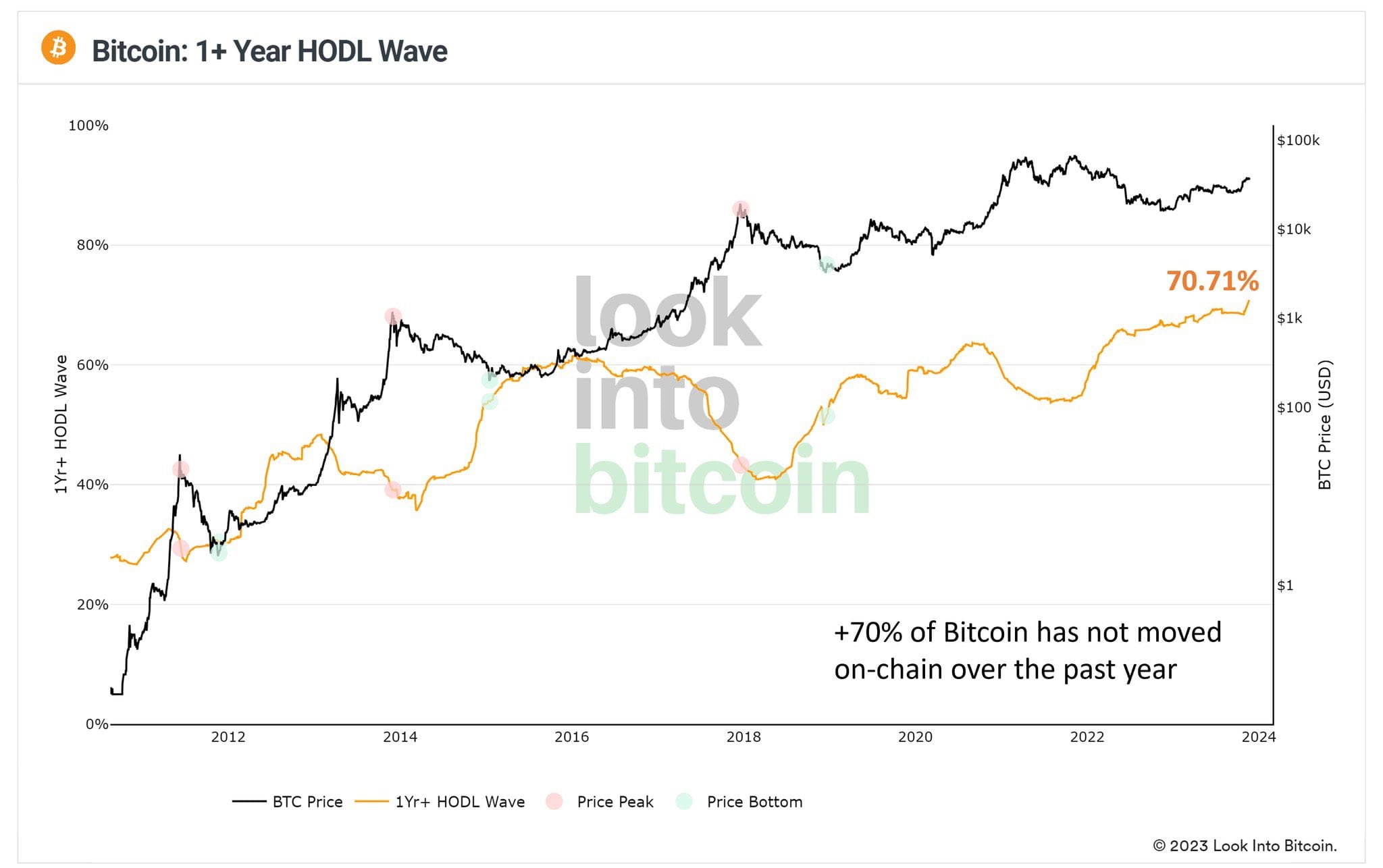

Paine also considers the potential sale of old BTC based on the metric HODL Waves, estimating that 15-20% of the old circulating supply could come up for sale. In an extreme scenario, if 20% of old BTC were sold over the next four years, this would amount to approximately 3.8 million BTC.

To achieve a $1 million valuation per BTC, Paine argues that a total capital influx of approximately $4.5 trillion would be needed. He identifies two major potential sources for this capital: US retirement savings and US corporate treasuries.

Additional Factors Driving BTC's Price to $1 Million

Paine highlights several other factors that could drive Bitcoin's price to $1 million. These include further adoption by nation-states, the implications of new money creation affecting the global bond market, a reduced supply of old BTC due to steadfast holders, the decline of alternative cryptocurrencies, a refocusing of capital towards Bitcoin, and technological advancements such as Taproot.

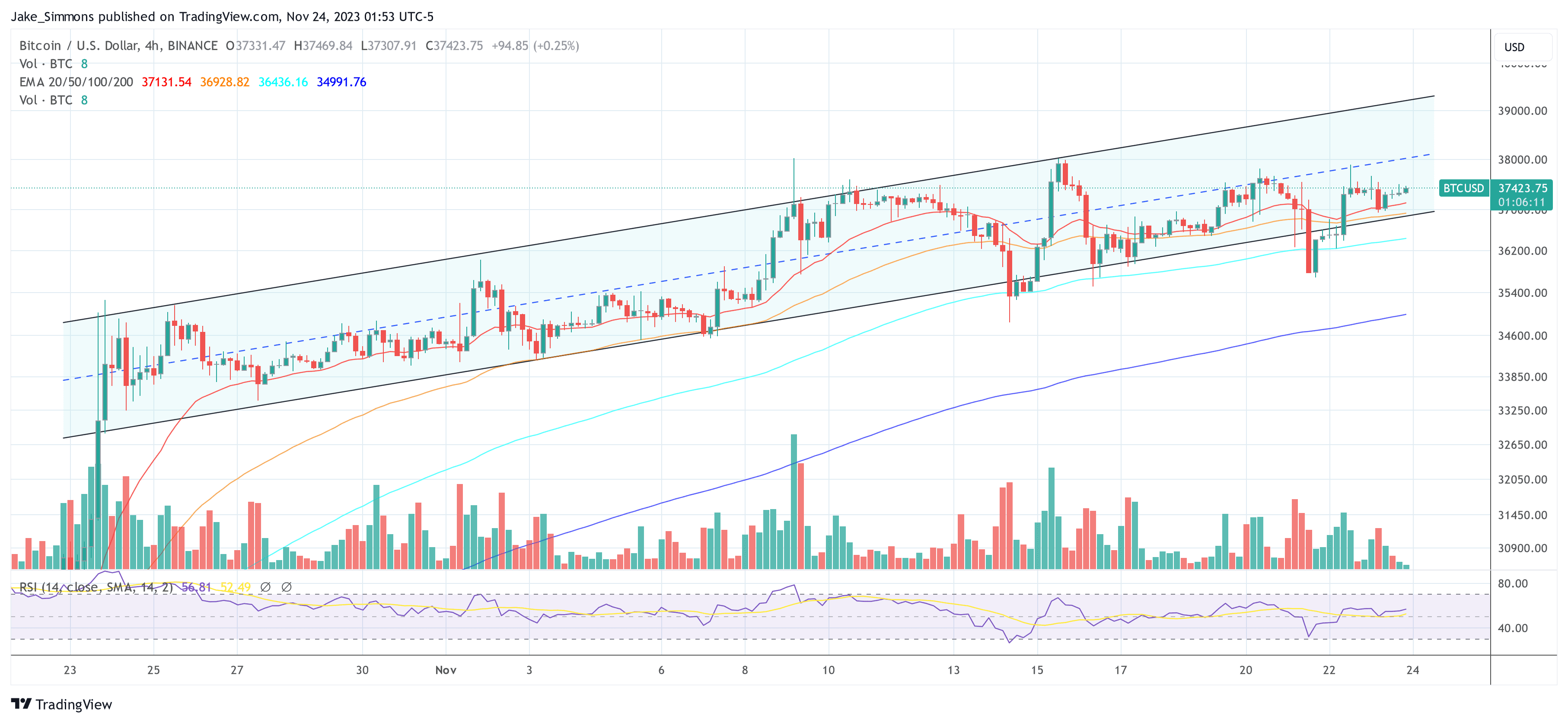

At the time of writing, BTC is trading at $37,423.

Hello, I’m Timothy Robinson, News Editor at NewsRoomFeed.com, where I turn the world’s chaos into digestible stories. Blessed with a journalism degree from UNT, I’ve been molding minds and spreading knowledge from the tranquil setting of Denver, CO.

My days are spent in the throes of international affairs, political commentary, and local happenings, but when the laptop closes, you’ll see a completely different side of me. I’m an avid tennis player and cycling enthusiast. I never shy away from a good adventure. My Labrador, Rocky, is always by my side as we explore the great outdoors of Colorado.

Traveling is my stimulant. It’s my way of stepping into new narratives, experiencing different cultures, and appreciating the beautiful tapestry of life. Each new place I visit fuels my creativity and broadens my perspective, which I pour back into my work at NewsRoomFeed.

When I’m not on the road with Rocky or lost in a gripping news story, you’ll find me on the tennis court or cycling around Denver. These hobbies keep me grounded and offer a refreshing escape from the digital universe.

I believe in creating a balance between the hustle of work and the peace in nature. So, if you’re looking for a fresh take on news, a travel companion, or an opponent on the tennis court, don’t hesitate to connect. Let’s turn the page on the ordinary and dive into the extraordinary!