Crypto

Bitcoin and Solana Lead Institutional Inflows in Cryptocurrency Market

Continued Interest from Institutional Investors

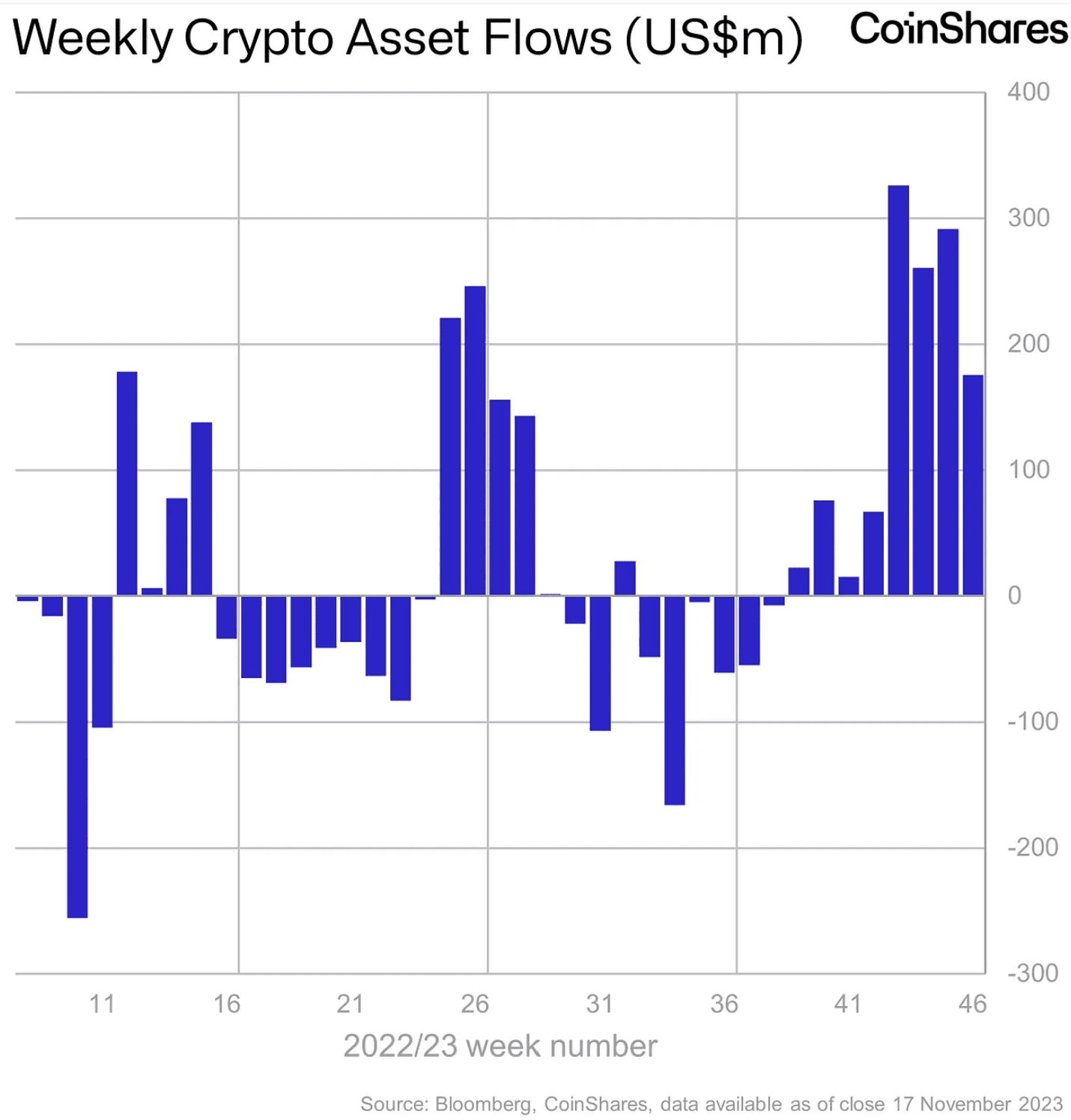

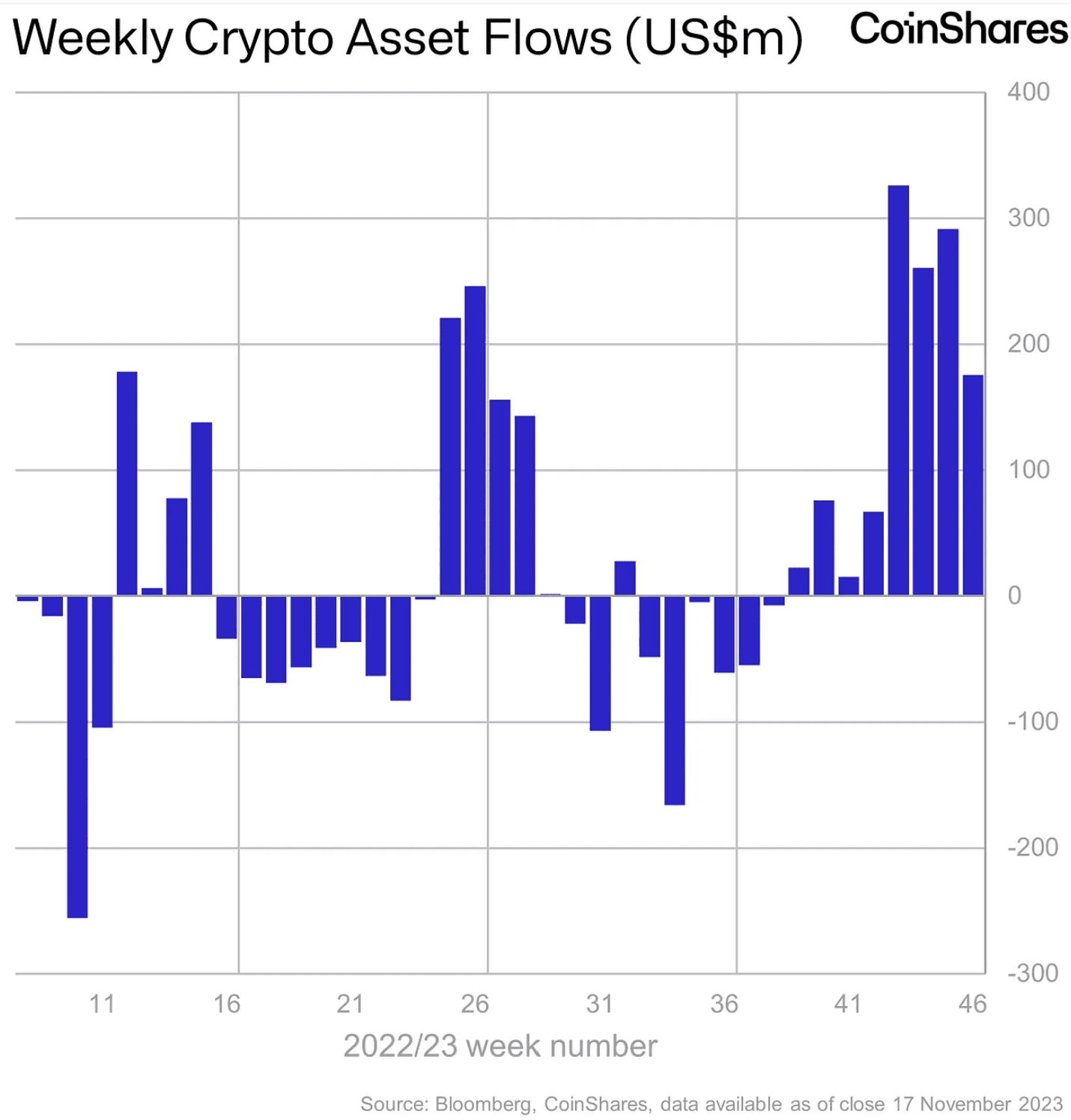

In the latest weekly report from CoinShares, Bitcoin and Solana are emerging as leaders in institutional inflows, indicating sustained interest from sophisticated investors in the cryptocurrency market. Digital asset investment products saw inflows totaling $176 million last week, marking an 8-week streak of consecutive inflows.

Bitcoin Dominates Inflows

Bitcoin has seen the bulk of these inflows, with $154.7 million coming in for the week. This continued positive sentiment is likely related to the anticipated approval of a spot-based Bitcoin ETF in the US, according to James Butterfill, head of research at CoinShares. The asset under management for Bitcoin stands at $30,782 million, reaffirming its dominance in the market.

Solana's Growing Presence

Solana has seen the second largest inflows of $13.6 million for the week, highlighting its growing presence and potential in the institutional space. It currently has a year-to-date inflow of $135 million.

Mixed Results for Other Cryptocurrencies

Ethereum had a modest weekly inflow of $3.3 million, but has experienced a year-to-date outflow of $55 million. Other cryptocurrencies like Litecoin, XRP, and Cardano showed positive inflows for the week, albeit on a smaller scale.

Flows by Country

Canada led the way with an impressive $97.7 million in weekly inflows, followed by Germany at $63.3 million and Switzerland at $35.4 million. In contrast, the United States saw outflows amounting to $19.2 million for the week.

Key Indicator of Institutional Behavior

The data provided by CoinShares serves as a key indicator of institutional behavior and sentiment in the Bitcoin and crypto space, offering valuable insights into market trends and potential future movements. Solana seems to be the top choice among altcoins.

At press time, Solana traded at $60.26. On a bullish note, SOL closed the last week above the 0.382 Fibonacci retracement level.

Hello, I’m Timothy Robinson, News Editor at NewsRoomFeed.com, where I turn the world’s chaos into digestible stories. Blessed with a journalism degree from UNT, I’ve been molding minds and spreading knowledge from the tranquil setting of Denver, CO.

My days are spent in the throes of international affairs, political commentary, and local happenings, but when the laptop closes, you’ll see a completely different side of me. I’m an avid tennis player and cycling enthusiast. I never shy away from a good adventure. My Labrador, Rocky, is always by my side as we explore the great outdoors of Colorado.

Traveling is my stimulant. It’s my way of stepping into new narratives, experiencing different cultures, and appreciating the beautiful tapestry of life. Each new place I visit fuels my creativity and broadens my perspective, which I pour back into my work at NewsRoomFeed.

When I’m not on the road with Rocky or lost in a gripping news story, you’ll find me on the tennis court or cycling around Denver. These hobbies keep me grounded and offer a refreshing escape from the digital universe.

I believe in creating a balance between the hustle of work and the peace in nature. So, if you’re looking for a fresh take on news, a travel companion, or an opponent on the tennis court, don’t hesitate to connect. Let’s turn the page on the ordinary and dive into the extraordinary!