Crypto

Bitcoin Price Prediction: Model Points to $732,000 Per Coin

A Predictive Model with a Track Record

Bitcoin price can be unpredictable. But shockingly, a specific model managed to predict the peak in 2021 at above $60,000 as far back as 2019. That same model is now pointing to a peak range near $732,000 per coin. Is this a realistic estimate, or pure hope? Let’s take a closer look at the model and find out.

A More Accurate Model than Plan B's S2F

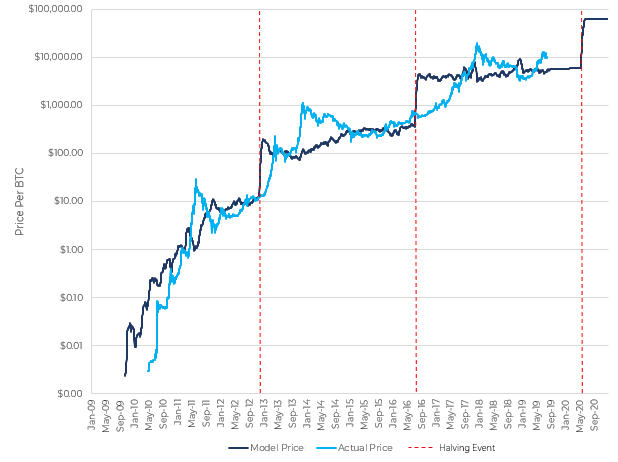

Back in 2019, the go-to model for predicting future Bitcoin pricing was Plan B’s now debunked Stock-To-Flow (S2F) model. But around the same time, Greg Cipolaro took a stab at modifying the S2F model with highly accurate results. While Plan B’s take failed to bring the price per BTC above the projected $100,000 or more, Cipolaro’s model nailed a peak range near $60,000.

What the Model is Based On

The model is based on post-halving supply reduction price targets. More importantly than what happened after the 2020 halving, however, is what Cipolaro’s model predicts after the next halving. While getting it right just one time per Cipolaro’s model is notable, it could be a matter of luck or coincidence. If the model works again, the higher the likelihood he’s onto something significant.

A Strikingly High Target

Especially when the next projected target is $732,000 per BTC. The target is much higher than most estimates out there, which point to between $100,000 and $200,000 per coin. This is roughly an 1,800% increase from current levels.

Bitcoin's History of Surges

From the Black Thursday low at $3,800 to the 2021 peak at $68,000 represents nearly a 1,600% return, so such numbers aren’t outside the realm of possibility for the king of crypto. During the year of 2017 alone, Bitcoin surged by over 2,000%. And this occurred after the price had appreciated by over 400% already. Today, Bitcoin is up 140% off 2022 lows. Could the top cryptocurrency by market cap add another 1,800% on top of that to reach the model’s predicted peak?

Hello, I’m Timothy Robinson, News Editor at NewsRoomFeed.com, where I turn the world’s chaos into digestible stories. Blessed with a journalism degree from UNT, I’ve been molding minds and spreading knowledge from the tranquil setting of Denver, CO.

My days are spent in the throes of international affairs, political commentary, and local happenings, but when the laptop closes, you’ll see a completely different side of me. I’m an avid tennis player and cycling enthusiast. I never shy away from a good adventure. My Labrador, Rocky, is always by my side as we explore the great outdoors of Colorado.

Traveling is my stimulant. It’s my way of stepping into new narratives, experiencing different cultures, and appreciating the beautiful tapestry of life. Each new place I visit fuels my creativity and broadens my perspective, which I pour back into my work at NewsRoomFeed.

When I’m not on the road with Rocky or lost in a gripping news story, you’ll find me on the tennis court or cycling around Denver. These hobbies keep me grounded and offer a refreshing escape from the digital universe.

I believe in creating a balance between the hustle of work and the peace in nature. So, if you’re looking for a fresh take on news, a travel companion, or an opponent on the tennis court, don’t hesitate to connect. Let’s turn the page on the ordinary and dive into the extraordinary!